Invoice Discounting

Take control of cash flow in confidence

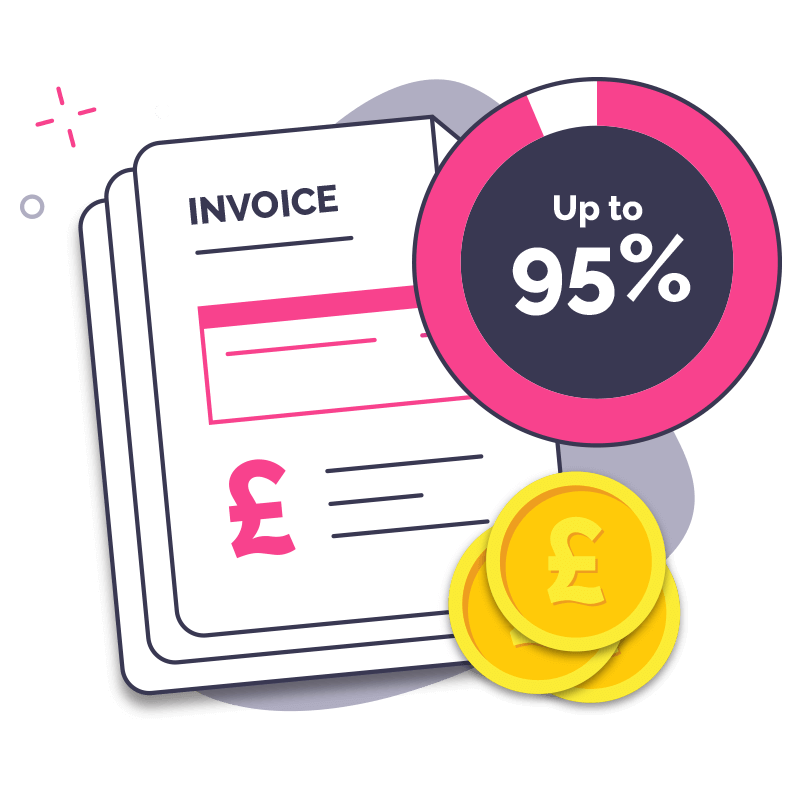

- Receive up to 95% of invoice value

- Sell single or multiple invoices

- Fast, stress-free funding in 24 hours

Quick Decision with No Obligation

Take control of cash flow in confidence

Quick Decision with No Obligation

Invoice Discounting allows your business to sell its sales ledger, but unlike invoice factoring, you stay in control of your credit control process as usual. This means that your customers will not notice you are using an invoice financing facility, keeping it confidential.

Invoice discounting is a confidential arm of invoice finance and a popular choice for businesses large and small. If you don’t want to relinquish the control of chasing payments and collections but you do want to release up to 95% of the value of your sales invoices, keep reading to learn more about this financial solution.

Invoice discounting can release significantly more funding than a traditional bank loan or overdraft facility. The funding amount available will depend on the invoice amounts.

It's arranged in a completely confidential way, so your customers don’t know that you’re borrowing against their invoices. Nothing changes.

There's no need to provide additional asset security. This is a significant advantage over other business loan products.

You still manage the client account in the same way, as invoice discounting takes control of the cash flow in the background.

Invoice discounting keeps you in control with your sales ledger operations. You remain in control of chasing and collecting payments.

There are other business additions available such as bad debt protection, payroll support, which helps to free up your time and protects your business from risk.

Quick Decision with No Obligation

Some of the funders we work with

An invoice discounting facility gives your business the immediate working capital it needs while retaining full control of your sales ledger and relationships with your customer. Payment is made to you in two separate instalments.

Sell your products or services to business customers as usual and issue invoices with a 30 to 90-day payment term.

Once your facility is set up you can choose a large portion of debtors or your entire sales ledger, sometimes known as ‘whole-turnover’ discounting to release cash against. The invoice financier will simply ‘buy’ the debt (providing it is within credit terms) that is owed by your customers.

Looking to sell just one invoice? If you just want to choose a single invoice or select multiple invoices to sell on an ad hoc basis, selective invoice discounting may be a better fit.

Receive an invoice advance up to 95% of the value of your sales invoices in 24 hours.

You chase and collect payments from customers as normal. When the invoice is due, the client pays the invoice to the invoice finance providers account. This is a completely confidential process.

If you are looking to free up your time from chasing late payments, then an Invoice Factoring facility can help.

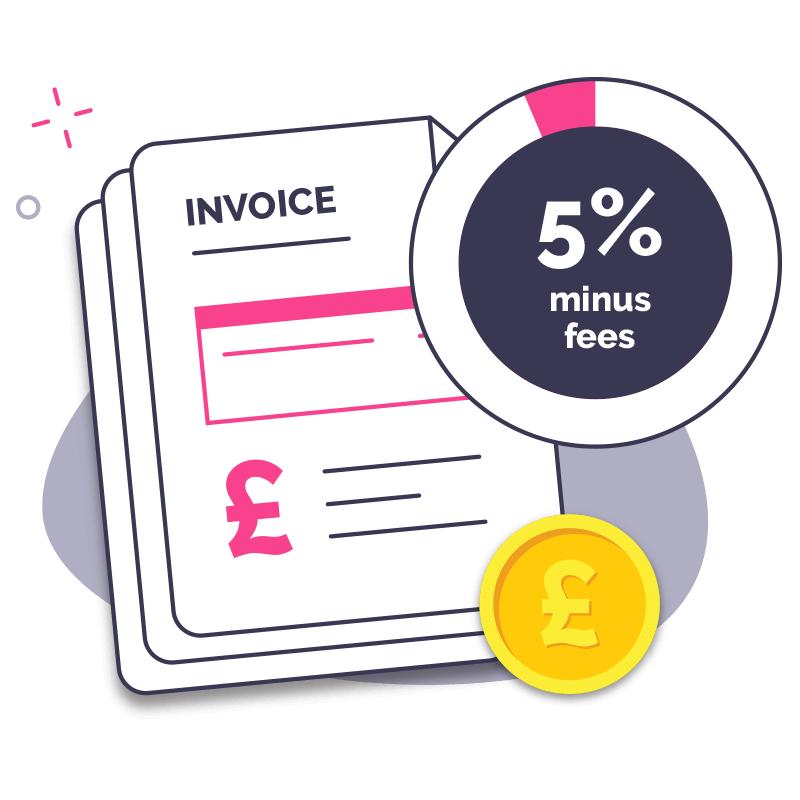

Compare FacilitiesYou will then receive the remaining balance, minus any fees and charges agreed with the invoice finance provider.

Get your free, tailored, no-obligation quote today

Apply NowQuick Decision with No Obligation

Invoice discounting is suitable for most types of businesses who trade directly with other companies on standard credit terms. The business must be based in the UK or Ireland and have a minimum annual turnover of £100,000.

Whether you work in recruitment, engineering or manufacturing - an invoice discounting facility will suit the majority of UK SME sectors.

You are a Limited company, LLP or sole trader

You have an annual turnover of £100,000 or more

Your business is based in the UK or Ireland

You sell to other businesses on payment terms

Quick Decision with No Obligation

The cost of the facility typically involves two main fees, a service fee and a discount fee. These fees can vary significantly from business to business, but your industry sector, trading history and how frequently you invoice can all have an impact. The cost will be made clear to you before you sign into an agreement.

This is the cost of having the facility and is calculated as a percentage of your gross turnover.

This is the cost of borrowing and is calculated as a percentage of the invoice value.

Get your free, tailored, no-obligation quote today

Apply NowQuick Decision with No Obligation

Confidential invoice discounting is a great way to manage your businesses cash flow. Cash flow issues can quickly become a burden for any business - invoice discounting takes the worry and stress cash flow issues can cause - leaving you to focus on delivering high-quality services and products to your customers. Don’t let cash flow issues stop you in your tracks when there is an easy solution for your business.

Invoice discounting can help you secure money fast - with monies deposited into your business bank account with immediate effect. Discounting can also help you secure significantly more funding than a traditional bank loan. The amount you’re eligible to receive will be dependent on the invoice amount.

Apply NowQuick Decision with No Obligation

At SME Invoice Finance, we can help you release the cash locked in your cash flow. Our funding panel can help you release up to 95% of the cash value of your sales invoice! The process is quick and easy and helps you get on top of your cash flow once and for all.

We understand just how much a cash flow situation can negatively affect your business and it’s day-to-day running - which is why invoice discounting can help with immediate effect.

The process is 100% confidential throughout - so your customers remain unaware of the working relationship.

Quick Decision with No Obligation

Confidential invoice discounting allows your business to get an advance against outstanding invoices in a confidential arrangement. This means that you manage credit control as normal so customers are unaware that you are using a funding facility.

"Recourse" and "Non-recourse" invoice discounting are terms simply used to describe the party who will be liable to pay back the invoice value should your customer fail to pay the invoice or become insolvent.

Invoice discounting is confidential because you do not hand over credit control processes to the lender. This means your customer relationships are not affected, and they won’t know that you are using a facility.

Yes. If you are looking to sell one invoice, you can use single invoice discounting. Unlike a full ledger discounting, this flexible facility lets you choose a single customer invoice on an ad-hoc basis without signing any long term contracts.

Although they both provide funding tied up in unpaid invoices, the fundamental difference between them is who manages your credit control. Discounting allows you to stay in control of the administration of your sales ledger, whereas with factoring, the lender will handle this for you on your behalf.

Since 2014, we've helped many businesses, large and small, get access to the working capital they need through invoice financing.

We can help any UK business that invoices other companies on credit terms for the goods and services that they provide.

Get your free, tailored, no-obligation quote today

Apply NowQuick Decision with No Obligation