Invoice Factoring

Funding with full credit control services

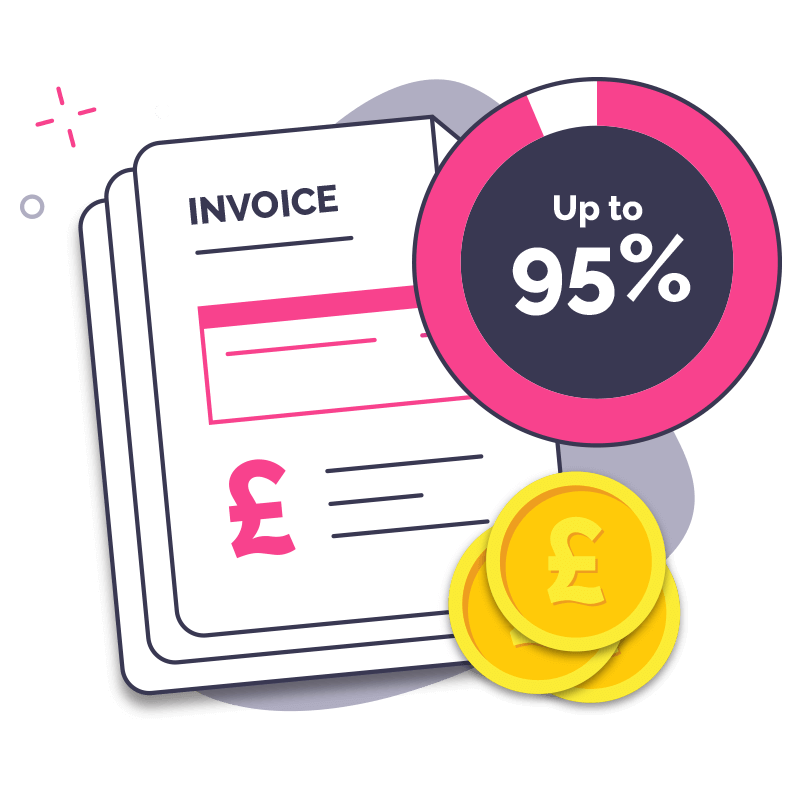

- Receive up to 95% of invoice value

- No need to chase payments

- Fast, stress-free funding in 24 hours

Quick Decision with No Obligation

Funding with full credit control services

Quick Decision with No Obligation

Invoice factoring, also known as debt factoring, is a popular type of invoice finance that enables businesses to sell their invoices to a factoring company in return for instant access to money owed from clients or customers. It is one of the most widely used products within invoice financing, unlocking as much as 95% of the money tied up in outstanding invoices.

With invoice factoring, you get the added benefit of not having to worry about chasing your customers’ payments. This is because the factoring company takes over your company’s credit control processes - collecting payment directly from clients when the invoices are due.

As well as this, this flexible funding solution gives you freedom to choose whether you want to sell a single invoice every now and then, or your whole sales ledger to a lender at a discounted rate.

It’s time for your business to take control of its cash flow and free up resources from invoice payment collection and management.

Invoice factoring can provide your business with a quick working capital boost, giving you access to up to 95% of your outstanding invoice value in as little as 24 hours.

For businesses, time is money. When you outsource your credit control with debt factoring, you free up time and resources that can be spent in other key areas of your business. Help your company grow with invoice factoring services.

The UK’s late payment problem is an issue that continues to impact SMEs. If you continually experience late payments, giving up credit control to the financier can help to reduce this risk of bad debt accumulating. Within invoice factoring companies, a dedicated team of professionals will manage all client collections on your behalf.

Cash flow - the lifeblood of a business. Waiting for 30 - 90 day payment terms to lapse to receive money owed for services can impact your business’s day to day runnings. With invoice factoring, the money is released and made immediately available to you as soon as your invoices are submitted. This creates a smooth cash flow for your business.

There's no need to provide additional asset security to be approved for an invoice factoring arrangement. As a small or medium sized business, you might not be in the position to offer up valuable business assets. For this reason, debt factoring provides a significant advantage over other business loan products, helping startups and SMEs grow.

When you sign on for an invoice factoring facility, you can benefit from additional business solutions, such as bad debt protection and payroll support. These extras can help to free up even more time and resources, while protecting your business from risk.

Quick Decision with No Obligation

Some of the funders we work with

Through invoice factoring, businesses can sell their outstanding client invoices to a factoring provider and receive instant access to a large percentage of the total invoice value. Invoice factoring works to reduce the gap between invoice issue date and payment date, benefitting company cash flow.

With an invoice factoring facility, you receive payment in two instalments. The first instalment releases up to 95% of the invoice value upfront. Then, once payment from the client has been made, the remaining invoice balance is issued in a second instalment, minus any fees and charges incurred.

Unlike invoice discounting, with a debt factoring arrangement you relinquish payment collection to the financier, so you don’t need to worry about chasing clients on the invoice due date.

With an invoice factoring facility, securing a cash advance couldn’t be easier. Get a better idea of how this type of invoice finance could work for your business in five simple steps.

Sell your products or services to business customers as you normally would, and issue invoices with a 30 to 90-day payment term.

Once your facility is set up, you choose which invoices to advance. This could be a large portion of debtors, or your entire sales ledger to release cash against. The latter option is also known as ‘whole turnover’ discounting. The invoice financier will simply ‘buy’ the debt (providing it is within credit terms) that is owed by your customers.

Looking to sell just one or two invoices? If you just want to choose a single invoice, or select multiple invoices to sell on an ad hoc basis, selective invoice factoring may be a better fit.

Once the invoice factoring agreement has been arranged, you can receive an advance on your invoice within just 24 hours. This means you could access a cash flow boost of up to 95% of the value of your sales invoices.

The factoring company manages all credit control and takes responsibility for chasing payments, so you don't have to! This means no more worrying about following the correct processes to ensure your clients pay up - it’s all handled for you.

If you would prefer to manage and collect payments yourself, then CHOCCs factoring (Customer Handles Own Credit Control) is available, or an Invoice Discounting facility may be a better option.

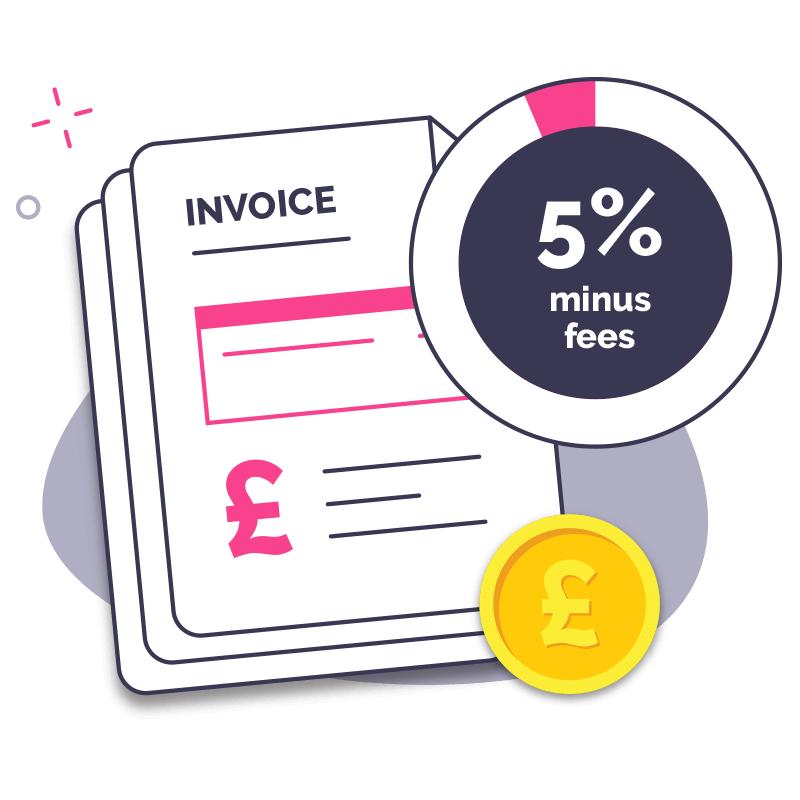

Compare FacilitiesAfter the payment has been made by your client, the invoice factoring company will transfer the remaining invoice balance to you. This second instalment will be deposited into your account, minus any fees and charges you had previously agreed with your provider.

Get your free, tailored, no-obligation quote today

Apply NowQuick Decision with No Obligation

If your business invoices other businesses for products and services, then you could be eligible for invoice factoring. We help UK SMEs access factoring to help their businesses flourish and grow. With credit control being outsourced to the finance provider, factoring is most suited to sole traders and smaller businesses that may not have the resources to manage this internally.

Regardless of sector, invoice factoring is suitable for the majority of UK SME businesses - from manufacturing and construction to recruitment agencies and wholesale. Many of these industries commonly suffer from late payments all the way through the supply chain, which is why debt factoring is such a game changer within corporate credit. We’re confident that we can help you find the tailored funding solution your business needs to grow.

Here at SME Invoice Finance, we can help businesses with invoice factoring if they meet the following criteria:

You are a Limited company, LLP or sole trader

You have an annual turnover of £100,000 or more

Your business is based in the UK or Ireland

You sell to other businesses on payment terms

Quick Decision with No Obligation

Before diving headfirst into any business loan product, it’s important you first understand the costs associated with the funding solution you’re considering. Knowing what costs are involved allows you to weigh up whether your business can realistically afford it, or whether there’s a better-suited product out there.

Invoice factoring costs tend to be more affordable than other loan options, but there are a couple of charges you should be aware of.

The cost of invoice factoring typically involves two main fees: a service fee and a factoring fee. These fees can vary significantly from business to business - your industry sector, trading history, and how frequently you invoice can all have an impact. But don’t worry, the total invoice factoring cost will be made clear to you before you sign into an agreement.

This is the cost of your business having an invoice factoring facility. It is calculated as a percentage of your gross turnover.

This is the cost of borrowing under an invoice factoring agreement. It is calculated as a percentage of the invoice value, taking into consideration the additional cost of outsourcing invoice payment collection.

Get your free, tailored, no-obligation quote today

Apply NowQuick Decision with No Obligation

If you’re looking for a business funding product that lets you relinquish control of chasing invoice payments, then invoice factoring could be the perfect solution!

Did you know that 3 in 5 UK SMEs are owed money from late payments? As of 2022, the UK’s late payment crisis is threatening the survival of over 400,0000 small businesses Unfortunately, it’s an issue that’s only getting worse, but invoice factoring could help.

Not only does debt factoring give you access to instant cash, it also helps to free up resources within your company - eliminating time spent chasing down clients for payment.

By leaving your invoice administration to a factoring provider, you can focus on achieving your business goals and take your company from strength to strength. There’s no need to worry about lengthy payment terms either, invoice factoring unlocks money owed in just 24 hours.

Apply NowQuick Decision with No Obligation

With the financier taking the reins when it comes to your whole sales ledger, you are able to free up time and resources within your business to focus on other important areas you might have been neglecting. Invoice factoring provides a smooth transition, letting your clients know that you are working with a factoring provider, but that nothing will change for them. The only difference is who sends the communications.

Not all businesses feel comfortable with their clients knowing about this arrangement. If you’d prefer a more confidential invoice finance service, read all about our invoice discounting facility.

Debt factoring is the most common funding solution for SMEs struggling with cash flow. Unlike taking out a business loan, with invoice finance you are essentially receiving an advance on the money your company is already owed for its services, making it a less risky option for funding.

Business owners tend to lean towards invoice factoring because of the many benefits it provides. Instead of worrying about cash deficits, or when client payments will be made, you can focus your energy on areas that are important for business development and expansion.

Quick Decision with No Obligation

The purpose of invoice factoring is to help businesses receive money owed in outstanding client or customer invoices upfront. It helps to eliminate lengthy payment terms and remove the stress and worry that late and overdue invoices can cause. It is primarily a cash flow solution that provides companies with greater stability.

Invoice finance facilities offer huge benefits to company cash flow. By immediately releasing money tied up in outstanding invoices, factoring helps to combat short term cash flow issues. It frees up working capital and enables businesses to take on more work without being held back by periods of low cash flow.

Instead of having to wait 30 - 90 days for payment terms to lapse, businesses can receive money owed in 24 hours. This can make a huge difference when you consider how much of an impact 3 months can have on a company’s success.

As well as benefiting cash flow by releasing money tied up in a company’s accounts receivable, invoice factoring offers businesses other major advantages.

1. Get financial flexibility: Whether you want to sell your invoices every now and then on an ad-hoc basis, or sign up for a long-term commitment to sell your sales ledger, invoice factoring can help.

2. Save time and business resources: Your credit control is managed by the factoring provider, which means you don’t have to worry about collecting invoice payment reminders or collection.

3. Improve relationships with customers: Many businesses find that invoice factoring strengthens their relationships with clients. The transition is smooth, and it leaves you to focus on your providing the best service possible.

4. A funding solution with high approval rates: With invoice factoring, company credit score is not the main determiner or approval. You are advancing cash that is already owed to your business, which makes it easier to apply for.

5. No additional assets required as collateral: Lots of business loan products require companies to provide collateral. More often than not, startups and small businesses don’t have the luxury of being able to risk these assets, which is why invoice factoring is popular with UK SMEs.

No, invoice factoring is not currently regulated in the UK. It’s important to understand that no asset based finance is regulated by the leading Financial Conduct Authority, which is why choosing a legitimate factoring provider is so important.

Though similar, the main difference between factoring and invoice discounting is the way that client payments are collected. With invoice factoring, the invoices are sold and the provider takes control of the sales ledger and responsibility to collect debts.

Invoice discounting on the other hand, lets businesses retain credit control.

Debt factoring is another term for invoice factoring. Debt factoring allows businesses to raise cash by selling their 'accounts receivables', in other words, their unpaid invoice debts, to a third-party provider.

When a business agrees to this arrangement, the debt factoring company takes over responsibility for credit control management and client communications.

Yes, you can! With single invoice finance, a selective factoring facility allows you to release funding against a single invoice or debtor when you need to. Also referred to as spot factoring, this invoice solution is flexible and can be used without signing up for lengthy contracts.

Yes, you can. Unlike traditional loans, lenders will look at your clients' creditworthiness, not your business credit history. This is because your business is receiving an advance on cash that is already owed. So even if you have bad credit, you could be eligible for invoice factoring.

In the event your client fails to make payment or goes bankrupt, the party liable depends on the type of agreement signed within the invoice factoring terms of contract.

Put simply, one of two things could happen. Under a recourse factoring agreement your company would have to pay back the money owed, but under a non-recourse factoring agreement, the factoring company would absorb the debt.

Both of these terms refer to liability in the event of non-payment from a business’s clients or customers. There is one fundamental difference between recourse and non-recourse invoice factoring - and it’s an important one to be aware of:

Recourse Factoring - This type of factoring agreement means that your business will be liable to pay back the invoice value should your customer fail to pay the lender.

Non-recourse Factoring - This agreement usually includes a type of bad debt protection that mitigates the risk of non-payment by your customers. It means that your business will not be liable to pay the invoice value if your customer fails to pay.

CHOCCs (Customer Handles Own Credit Control) is also known as CHOCs (Customer Handles Own Collections), and it works the same way as an invoice factoring facility, but you handle credit control.

It can be described as a blend between factoring and discounting. With a factoring facility, the provider will manage credit control on your behalf, and any customer invoice payments are made directly to the provider. CHOCCs lets you manage and chase your customers, but invoice payments are still made direct to the factoring provider rather than you.

CHOCCs has many benefits, including the ability to maintain relationships. It is also a great option for young businesses that may not qualify for invoice discounting.

By using an invoice factoring broker like SME Invoice Finance, we can help save you time by matching your business to a range of suitable invoice factoring companies. Instead of having to research a wide variety of providers, our service can direct you to the perfect solution for your business’s needs.

Since 2014, we've helped many businesses, large and small, get access to the working capital they need through invoice financing.

We can help any UK business that invoices other companies on credit terms for the goods and services that they provide.

Get your free, tailored, no-obligation quote today

Apply NowQuick Decision with No Obligation